Fundamental Approach

The corporate philosophy of the Company is described below. The Company seeks to fulfill its social mission by serving as vital public infrastructure in the form of Japan's central financial instruments market.

<Corporate Philosophy>

We shall contribute to the realization of an affluent society by promoting sustainable development of the market by ensuring reliability and public visibility, laying the foundation of a market which is highly convenient, efficient, and transparent, and providing creative and attractive services. We believe that these efforts bring rewards in the form of profits resulting from the increased support and confidence of investors and other market users.

In order to conduct management in line with its corporate philosophy, the Company is aware of the importance of having its stakeholders understand its corporate philosophy and corporate activities. Therefore, the Company established the basic views on corporate governance from the following four perspectives to help stakeholders understand the Company's business and raise confidence in the Company.

(1) Corporate philosophy and social mission

JPX Group operates markets that are a public asset and fulfills its social mission by pursuing the sustainable development of its markets.

(2) Market operations

JPX Group operates the markets with the view that garnering support for and fostering confidence in the markets it establishes is in the common interest of all investors and market users, and maintaining and enhancing the support and confidence will build the foundations for sustainable development of its markets.

(3) Enhancing corporate value

In pursuing the sustainable development of its markets, the Company must continue to accommodate the diverse needs of shareholders and other stakeholders, and through this the Company will enhance its corporate value over the medium to long term.

(4) Effective corporate governance

The Company strives to constantly improve its corporate governance system to further facilitate effective and proper systems, so as to support the sustainable development of its markets.

Based on the basic views on corporate governance described above, in light of the intent of the individual principles of Japan's Corporate Governance Code, the Company is committed to properly developing its corporate governance system such as by developing a highly effective system of checks achieved through tension and harmony between the management and independent outside directors while striving to facilitate the smooth sharing of information and coordination between them.

| Corporate Governance Report |

|

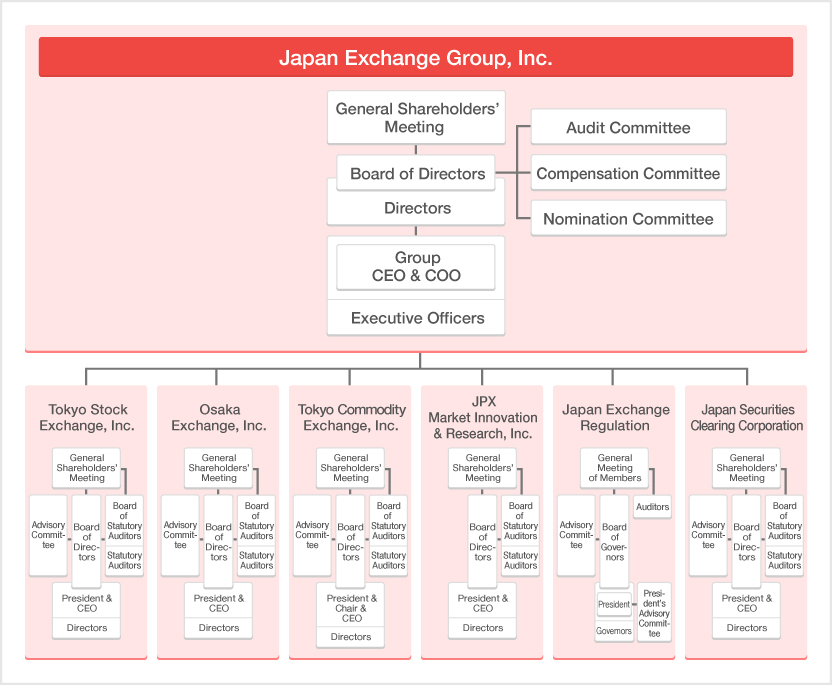

JPX Corporate Governance Chart

Board of Directors

Recognizing the importance of ensuring accountability to shareholders and other stakeholders and believing that it will contribute to the enhancement of its own corporate governance, the Company clearly segregates the management oversight and the business execution functions, adopting the structure of a Company with Three Committees (Nomination, Compensation, and Audit) to strengthen oversight and raise the transparency of management. As well as making decisions on basic management policies and important matters, the board of directors is composed of a majority of outside directors in order to improve management transparency and accountability and enhance supervision of the appropriateness of business execution, and is mainly responsible for the following supervisory functions.

(1)Management strategy

The board of directors monitors whether the Group's management strategies, including the Medium-Term Management Plan, are consistent with the Group's goal of increasing corporate value while fulfilling its social mission as a core infrastructure of the Japanese market based on the Company's corporate philosophy. In order to enhance the effectiveness of this, the board of directors discusses updates to the Medium-Term Management Plan for each fiscal year, monitors progress, and holds regular discussions with the Group CEO, as well as the president & CEOs of major business subsidiaries.

(2)Risk management

The board of directors supervises the Company's risk management in recognition that maintaining sound and stable business operations is crucial for JPX Group to continue raising corporate value while fulfilling its public role as a market operator. In order to enhance the effectiveness of this, the Risk Policy Committee, which consists primarily of outside directors, identifies the significant risks for each fiscal year and establishes basic policies for responses to each significant risk in a Comprehensive Risk Management Statement. This is then brought to a resolution by the board of directors. In addition, the Company receives reports on the status of company-wide risk management through the Risk Management Committee, which has been established on the executive side.

(3)ESG (sustainability)

The board of directors monitors the promotion of ESG (sustainability) issues based on the belief that in addition to responding to JPX Group's own ESG issues as a Group, supporting its stakeholders, especially listed companies and investors, in addressing various social issues from the perspective of financial and capital markets will contribute to the development of a sustainable and prosperous society. In order to enhance the effectiveness of this, the board of directors passes resolutions on basic policies related to human rights policies and climate change and receives reports on the status of activities and important matters in accordance with those policies.

<Policies related to the appointment of directors>

In order to reflect the opinions of diverse stakeholders in management and market operations, the Company has a basic policy of appointing directors with a diversity of expertise and experience, and in addition to appointing a majority of independent directors, striving to increase its proportion of female directors to at least 30%.

From the viewpoint of fully exercising the management oversight and business execution functions and ensuring appropriate and efficient operations as a board of directors, the board of directors consists of 16 members, of whom two are women and ten are independent. (At present, the percentage of female directors is 12.5%, but the company aims to increase this to 30% or more by 2025.)

| Action Plan to Raise the Ratio of Female Directors |

|

In addition, considering the Company's management strategy and the characteristics of the Company's business as a core infrastructure of the Japanese market, the Company identifies the following as expertise required of its directors: experience as a corporate manager; knowledge of the Company's business (finance, technology, etc.); expertise in financial accounting and auditing; expertise in law or risk management; and advanced academic experience or knowledge of government agencies, etc.

| Expertise |

Our Views |

| Corporate Management |

We believe that in order to practice management oversight of the Group with a high degree of sensitivity, it is necessary to have directors with experience as corporate managers. Since listed companies in particular are among the Group's key stakeholders, we believe it is necessary for the board of directors to include directors who have experience in the management of listed companies. |

| Finance |

We believe that directors with broad financial expertise are necessary to oversee the management of the Group, whose business is the operation of the core infrastructure of financial and capital markets. |

| Financial Audit |

We believe that directors with expertise in financial accounting and auditing are necessary to oversee the proper and efficient execution of the Group's business. |

Legal Affairs,

Risk Management |

Within the rapidly changing business environment surrounding the Group, we believe that directors with expertise in law and risk management are necessary to oversee appropriate risk management. |

| Researcher, Government Agencies |

We believe that directors with advanced academic experience or knowledge of government agencies or similar organizations are necessary to oversee the management of the Group, in aiming to create new services and achieve more sophisticated use of information while operating financial and capital markets in consideration of public visibility and public interest. |

| Technology |

We believe that the stability and reliability of trading systems and other systems are essential for the stable operation of financial and capital markets, and that directors with broad knowledge of technology are necessary to oversee the management of the Group, which is oriented toward the expansion of data and digital businesses. |

Nomination Committee

The nomination committee is comprised of 5 directors, 4 of whom are outside directors. This committee decides on proposals regarding the election and removal of directors to be submitted at the general shareholders meeting,etc.

Compensation Committee

The compensation committee is comprised of 5 directors, 4 of whom are outside directors. This committee determines the compensation of each individual director and executive.

Audit Committee

The audit committee is comprised of 5 directors, 4 of whom are outside directors - a certified public accountant. In addition to regular meetings, the audit committee also holds extraordinary meetings when necessary.

Based on the auditing plan and the distribution of duties determined at the audit committee meeting, efficient audits are conducted by monitoring and verifying the internal control system and its operational situation while maintaining close collaboration with accounting auditors, the internal auditing office, auditors of subsidiaries, and other relevant parties.

Internal Auditing Office

Internal control systems are established within each division to prevent violations of statutory laws and regulations, as well as JPX's articles of incorporation and other internal rules and regulations. Additionally, to reinforce the systems, we established an internal auditing office under the direct control of executive officer CEO and executive officer COO. The internal auditing office performs internal audits of each division and reports the audit results directly to executive officer CEO and executive officer COO.

![]() Close

Close