RN Prime Index Futures

Index calculation

(Note) For more details about the calculation method, please see “The Index Rule Book” on the website of Nomura Securities Co., Ltd.![]()

Index calculation method

The Russell/Nomura Prime Index (RN Prime Index) shows how much free-float adjusted market capitalization has been changed from the base date for the index, December 30, 1996.

The RN Prime is set at 1,000 points on the base date. When the index reaches 1,100 points, the Free-float Adjusted Market Capitalization is 1.1 times larger than that of the base date for the RN Prime.

Index calculation formula (excluding dividends)

Base market capitalization (t) = market capitalization (t - 1) + adjusted(*) market capitalization *1

- When the base market capitalization is adjusted, the adjusted value will be incorporated in the adjusted market capitalization

- Market capitalization used in this calculation is free-float adjusted.

- The return including dividends is also calculated. For more details about the index calculation, please see “The Index Rule Book” on the website of Nomura Securities Co., Ltd.

Example

Calculate an index value based on the following figures.- Previous day’s index value: 1,000 points

- Previous day’s market capitalization: ¥10 billion

- Today’s market capitalization: ¥12 billion

- Today’s base market capitalization is the previous day’s market capitalization, i.e. ¥10 billion.

Base market capitalization = ¥10 billion - Next, calculate the fluctuation of today’s market capitalization from the base market capitalization, i.e. the previous day’s market capitalization. This fluctuation is called “Return” and today’s return will be 0.2 ((¥12 billion / ¥10 billion) - 1 = 0.2). Today’s market capitalization is increased by 20% from that of the previous day.

Return = 0.2 - In order to reflect a 20% increase in the market capitalization of the index value, multiple the previous day’s index (1,000 points) by the return (0.2).

Today’s Index Value = 1,000 points + 1,000 points × 0.2 = 1,200 points

Adjusting base market capitalization

In the event of changes in a stock’s capital structure, such as public offering, private placement and so on, or changes in the composition of the index, the base market capitalization will be adjusted. This adjustment is carried out for the purpose of eliminating an increase or decrease in market capitalization not due to market changes, which maintains index continuity and makes it possible to compare the current index value with the previous index value.

Example

- When a component company in the index carries out a public offering for ¥1 billion on the previous day, the base market capitalization for the day is adjusted as follows:

Base market capitalization =

¥12 billion (previous day’s market capital) +¥1 billion (public offering) = ¥13 billion - When stock prices move up by 25% and the market value becomes ¥16.25 billion, the return and index price for the day will be as follows:

Return for the day = ¥16.25 billions / ¥13billions – 1 = 0.25

Index value for the day = 1,200 points × (1 + 0.25) = 1,500points - If the base market capitalization is not adjusted, the base market capitalization will be ¥12 billion and the market capitalization for the day will be ¥16.25 billion. As a result:

Index value for the day = 1,200 points × (¥16.25 billions / ¥12 billions) = 1,625 points - As shown in the above example, if the base market capitalization is not adjusted, increases or decreases in market capitalization not due to market changes, such as changes in a stock’s capital structure, affect index pricing. In this example, 125 of the 1,625 points result from the increase in market capitalization not due to market changes.

- In order to maintain index continuity, the base market capitalization will be adjusted when there is an increase or decrease in market capitalization not due to market changes.

Selecting rules for stock price

When a stock is listed on more than one exchange, the acquisition price will be the price on the exchange with the most accurate price for that stock, based on the stock’s percentage of days traded and total trading volume. Normally, the exchange is selected on a daily basis.

Concerning the acquisition price, a special quotation price on the selected exchanges is used. If this is not available, then the trade price on the selected exchange is used.

Calculation method of Free-float Adjusted Market Capitalization

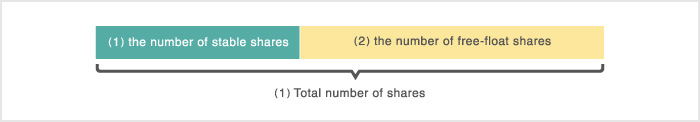

The RN Prime Index adopts Free-float Adjusted Market Capitalization in calculating the index. The number of free-float shares is calculated back from the stable shareholdings.

(1) Number of Free-float shares = (3) Total number of shares -(2) Number of stable shareholdings

Calculating formula of Free-float Adjusted Market Capitalization

Free float adjusted market capitalization = (A) × (B) × ( 1 - (C) )

(A) Market price

(B) The number of shares outstanding

(C) Stable shareholdings ratios

Stable shares, or non free-float shares, such as cross-held stocks between companies and the stocks held by major shareholders, are not traded in the market. In order to calculate the number of non free-float shares, the following method is used:

Calculation formula of stable shareholdings ratios

- Total number of non free-float shares (A) = the number of shares held by major shareholders (B) + the number of shares recorded in company reports (excluding (B)) (C)

- Single-year stable shareholdings ratios (D) = (A) / Total number of shares outstanding as of the end of the closing of accounts

- Stable shareholdings ratios = a two-year moving average of (D)

Data used in calculating stable shareholdings

- Toyo Keizai’s major shareholder data

- Declarations of marketable securities holdings contained in company reports

- ・Shares believed to be actively traded are excluded from stable shareholdings: e.g. funds managed by domestic trust banks and life insures (i.e., pension funds, investment trust), foreign banks, venture capital, etc.

- ・In the event of overlapping data, priority is given to the major shareholder data.

- ・Data used is the latest data available in regular reconfiguration.